As a business owner, you’re in control of your entire finances. You manage and determine how much to invest in everything on a daily. Although it’s true that you surely love your business, it doesn’t mean that you should just work for free. You have the option to pay yourself, and this is often overlooked by many dropshipping business owners.

However, paying yourself isn’t as simple as it sounds. There are many things to consider. That’s why in this article, I’ll discuss how to pay yourself as a business owner. Keep in mind that I’m specifically talking about dropshipping businesses, but this discussion may also apply to any other businesses.

How to Pay Yourself

How to pay yourself as a business owner?

Compensating yourself as a business owner is vitally important for you and your business. As someone who runs the business, your personal expenses should also reflect on your business expenses. By factoring in all expenses, including yours, you’ll know the current financial health of your company and if you need to make changes.

Do you need to cut costs? Market more? Or raise prices? You won’t be able to make informed decisions if you factor out your expenses. You may be tempted to work without getting paid but you should also recognize yourself and your time.

The idea of not paying yourself will only cause problems in the long run. You must be able to balance your business’ growth and your financial security. This payment should consider the following factors:

This means that you should be paying yourself depending on how profitable and stable your business is. If you pay yourself too much, your business will suffer. But if you pay yourself less, you may not be able to handle your business properly; then the business will also suffer.

Form Your Business As a Separate Legal Entity

Form your dropshipping business as a separate legal entity. You can form it as an S corporation or an and have it taxed as an S corporation. This way, you can pay yourself with a salary and the rest as a distribution.

Most business owners prefer to pay themselves this way. Also, taxes work differently for salary and distributions. That's why I recommend that you get an S corporation.

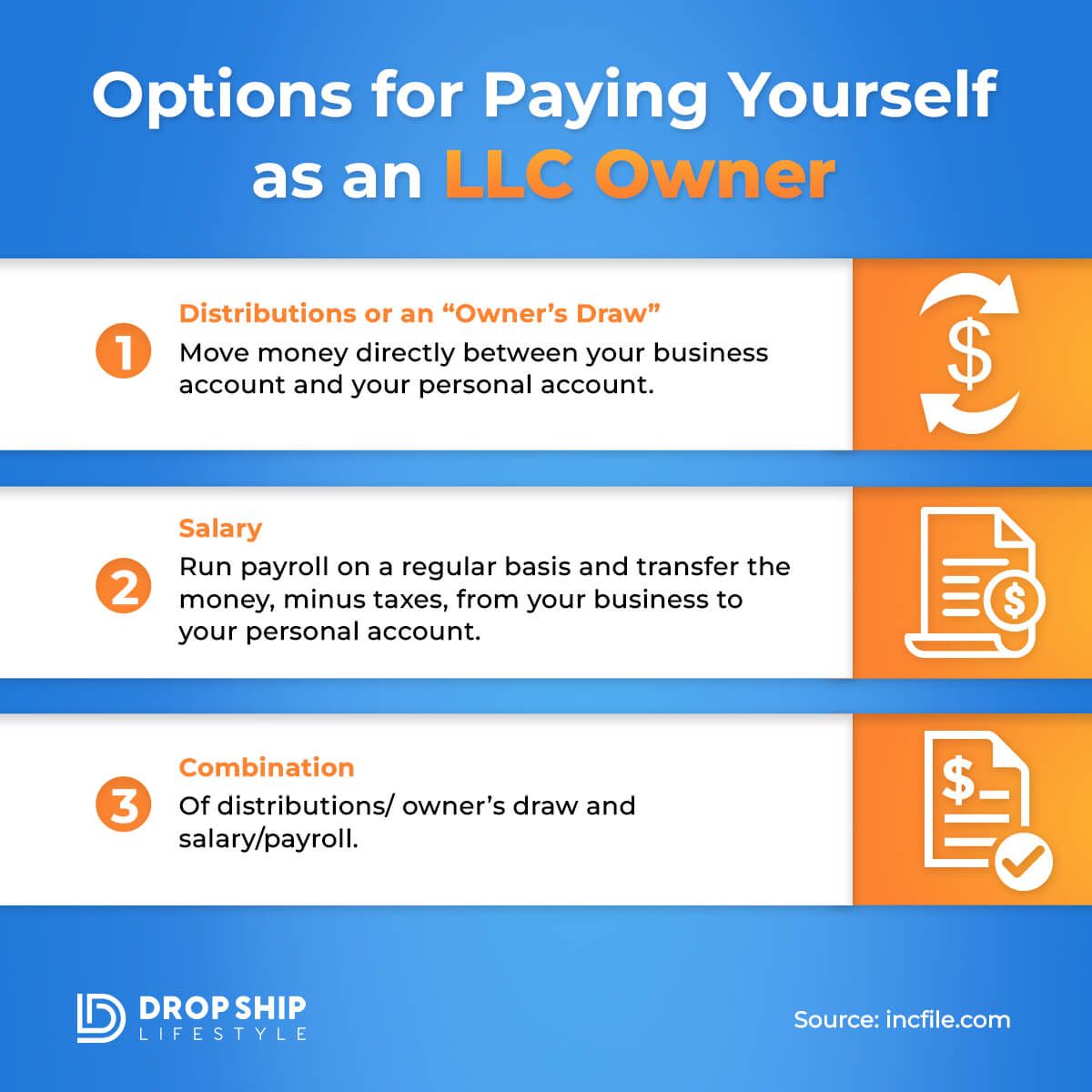

To help you understand better, here are the two main ways how to pay yourself as a business owner of a dropshipping business:

1. Salary

You can pay yourself a regular salary, just like how you would pay an employee of your business. Of course, this means you’ll also be withholding taxes from your paycheck. It’s legally required for an S-corporation or C-corporation business or a limited liability company taxed as a corporation. Since you’ll be forming your business as a separate legal entity, you’ll be required to do this.

Moreover, the IRS in the U.S. implements a reasonable compensation requirement that requires you to pay yourself a salary that’s comparable to what others in the same job in your industry would get paid.

With a salary, you’ll pay yourself a set rate and on a set schedule. It can be weekly, bi-weekly, or monthly. To decide on a specific amount for your salary, calculate your personal expenses first. Your salary should be able to cover your basic expenses such as your mortgage, loan, etc.

2. Owner’s Draw/Distribution

A draw and a distribution are the same thing. They represent the same concept, just for different business structures. In both cases, as a business owner, you draw money from the profits you made from your business.

How to pay yourself as a small business owner this way? You can take funds for your personal use, as much as you need. You can draw money up to the amount you put into the business, which is the owner’s equity. With this payment setup, you don’t have to worry about paying taxes upfront every time you make a draw.

However, you’ll need to set aside a budget for a tax bill at the end of every year because you still need to report that income and pay taxes at the end of the year. Make sure to keep all documents, like a business check, so you can easily and properly tax them.

How Much Should You Pay Yourself

When it comes to how to pay yourself as a business owner, the best advice, especially in the beginning, is to keep it modest but keep it realistic. Make sure that the pay will be enough to cover your expenses and keep it at that amount.

One way to come up with a decent figure is to audit your personal expenses. The minimum amount of cash you need per month should be enough to live. It should include:

Most business owners keep their salaries at least 10% higher than all of these combined. Make sure to be fair about it and pay yourself a consistent amount so you can run a functional living budget.

At the same time, don’t try to give yourself less than your living expenses. Remember that a modest and realistic pay will help you stay motivated in what you’re doing. This then helps you make better decisions for your business.

Additionally, you’d have to make sure your business has enough cash to cover these expenses:

Here are more tips you should follow to structure a modest compensation for yourself:

Pay Yourself As an Employee

Let’s use an example to help you better understand how you pay yourself as a business owner.

Let’s say your business made $1 million in sales in its first year. Out of these million dollars, you made $250,000 net profit between your expenses on ads, merchant fees, hires, etc. How do you pay yourself as a business owner out of this?

Salary

Once you’ve ensured that you’ve formed your business as a separate legal entity, decide how much you’d pay yourself. Again, keep it modest but realistic. Let’s assume that you’re currently renting a home, you have a car lease, and a family. Between all of your expenses, let’s say you’d need about $4,000 a month to pay for everything, and with enough extra, you can put towards the side. Assuming that this amount already covers your safety fee or your emergency expenses, you should have yourself as an employee of your company and make your salary at $4,000 a month.

This means that it would be a consistent amount, whether you decide to get your paycheck every two weeks or every month. That’s your salary to be the business owner, the CEO, or the president of your dropshipping business. With that amount, you’ll be making $48,000 in a year.

You might be confused as to why you would only be getting paid this amount of money if you’re making a $250,000 net profit. It’s because that amount is enough to cover your expenses. It’s a reasonable amount for someone to run your business.

Moreover, you have to keep in mind that the IRS keeps an eye on this so you need to be paying yourself a reasonable amount of money for the job. If you take that $48,000 from your net profit, you have $202,000 as profit left in your business bank account.

Now, how do you take that? How to pay yourself as a business owner from that?

Distributions

As an S-corporation business, you can take it as a distribution. Remember that distributions are taxed differently than salary. With salary, there are expenses for social security, like Medicare. Distributions don’t have the same taxes associated with them so you can save yourself about 15% in Medicare and Social Security.

This is why the IRS doesn't want you saying that your salary is only $1 per year and the rest is distribution. That is cheating and not fair to the system so don’t ever try to do that.

Do you have to wait until the end of the year to take the $202,000 out or pay tax on it? No, and you shouldn’t.

Remember that the money you’re paying yourself every month is enough to cover your expenses and safety net. But with the remaining amount of profit, take distributions throughout the year, although it may be more annoying for your accountant. Technically, you can take a distribution everyday as long as they are all reported when you’re paying your taxes.

Salary + Distributions

Based on these, I think the best way how to pay yourself as a small business owner from this is to set quarterly goals for your business in net profit. Also, choose a distribution that you want to pay yourself every month.

For example, in Q1, you might want to make a $100,000 net profit and if you achieve that, you’re going to take $50,000 as a distribution. So basically, you’ll have a salary of $4,000 per month and a $50,000 distribution for Q1 if you hit your goals.

Don’t worry. The rest of the money will still be going to your business so that at the end of the year if you don’t need it by then for your business, you can also take it as distribution.

I recommend setting different goals monthly and quarterly and when you hit those goals, take distributions based on numbers. This will be motivating and is a good way to know why you’re taking money out of your business.

Again, I still recommend leaving money in. Don’t take all the net profit out of distribution as quickly as you make them. There are some reasons for that:

These are write-offs and they should be coming out of your net profit, not after you pay yourself a distribution. This will also help save money on taxes since the money is coming out of the business. So whenever it’s possible to write anything off, you should definitely do it.

Tracking Your Expenses - Conclusion

There are many things to consider when deciding how to pay yourself as a business owner. Ultimately, you have to ensure that you’re paying yourself a salary that’s enough to cover your monthly expenses. You can take the rest as distributions from the net profit you make.

To make sure everything is well taken care of, make sure to track your expenses. You can use the tool XERO for this so you can track your expenses and your write-offs.

Hey Everyone,

As many of you already know I created Drop Ship Lifestyle after selling a network of eCommerce stores and then trying to find a community of other store owners to network with… What I found was a bunch of scammers who promised newbies they would get rich quick by following their push-button systems!

This led me to create a new community along with an online training program that shares how to build a REAL online business.

I’d love to hear what you think… it’s a 2.5-hour training designed to help you drop ship profitably… all for free.

Be sure to click here to check it out and send me your feedback!

If you go through the “How To Start & Grow A Hyper-Profitable Online Store” webinar and still have questions just contact me and I will help you out

good content

Thank you! 🙏